Depth of market (DOM)

Depth of market (DOM) offers transparency of pricing and lets you take advantage of lower spreads on some of our popular MT5 products. With DOM, the smaller the size of your trade, the tighter the spread we can offer.

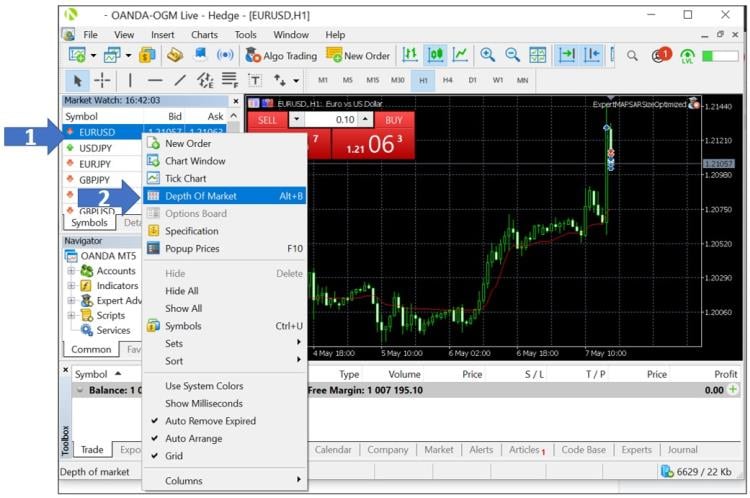

To access the DOM, please follow the instructions below:

1. Under Market Watch, right click on the desired instrument.

2. Click on Depth Of Market.

3. Alternatively, you can click on the Open Depth of Market icon located at the top left corner of the chart or press Alt +B on your keyboard as a shortcut.

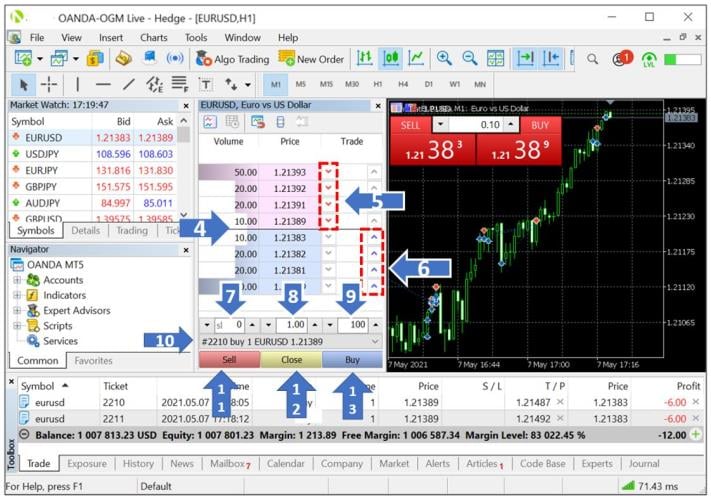

4. DOM quote and volumes : the DOM window displays the real time buy and sell price and order volume available at each market depth level.

5. One click sell limit : click on an arrow to place a sell limit order at that specific DOM level with the preset values of steps 7-9.

6. One click buy limit : click on an arrow to place a buy limit order at that specific DOM level with the preset values of steps 7-9.

7. Preset SL : add the preset stop loss for your DOM orders in points. For example, type in 200 for a desired stop loss of 20 pips.

8. Preset order size : type in the preset order size for your DOM orders in lots.

9. Preset TP : add the preset take profit for your DOM orders in points. For example, type in 200 for a desired take profit of 20 pips.

10. Order selector : select the open order when there are multiple open orders of the same instrument for step 12’s close order function.

11. Sell : places a sell order at market with the preset values of steps 7-9.

12. Close : closes the only open order for this instrument or close the selected order in step 10 when there are multiple open orders of the same instrument.

13. Buy: places a buy order at market with the preset values of steps 7-9.

How does the DOM function

On the DOM window, the buy and sell prices and volume offered at each depth level dynamically update to show the real time ask and bid price offered by OANDA.

We follow Full Amount Execution, where an order will be filled at price rate available for the requested size at that time and as streamed via the DOM in MT5 terminal. Users can monitor at any point of time the dynamic DOM streamed and have an idea at what price level larger orders could be executed.