What is Maximum Drawdown and how is it calculated?

5K to 200K (Static)

The Maximum Static Drawdown Limit is the maximum loss a user can sustain in the lifetime value of the account. It is set as a fixed limit at 10% from the initial balance and is not trailing up. Once the account equity reaches this level, a breach is triggered.

How is the Maximum Static Drawdown calculated?

The Maximum Static Drawdown Trigger level is calculated as 90% of the account's initial balance. This means that if the equity on the account falls to 90% or below of the starting balance (including any unrealized losses, profits, swaps, and dividends), the account will be breached.

Important Notes:

- The drawdown limit trigger level remains static at 90% of the initial balance at all times.

- A hard breach occurs if the account equity reaches this level.

Example

Virtual capital of $100,000

Max Drawdown Limit: $10,000 (10% of the initial balance)

Maximum Static Drawdown trigger level: $90,000 (90% of the initial balance)

Daily Loss trigger level: $95,000 ($100,000 - $5,000 (5% fixed from the Initial balance)

Day 1:

- Account registers an unrealized Profit: $2,000

- Equity on the account at End of Day: $102,000 (Initial balance + Unrealized profit)

Next Day:

- Max Loss Trigger Level: $90,000 (stays static at 90% of the initial balance from the start and does not trail up)

- Max Daily Loss trigger level: $97,000 = End of Day Equity $102,000 - $5,000 (5% fixed from the Initial balance)

Day 2:

- Account registers additional profit for the day of $1,500 total unrealized profit on the account reaches +$3,500

- Equity on the Account goes up to $103,500 ($100,000 + $3,500

- The Trader realizes the profit. The Balance = Equity = $103,500

Next Day:

- Max Loss Trigger Level: $90,000 (stays static at 90% of the initial balance from the start)

- Max Daily Loss trigger level: $98,500 = End of Day Equity of $103,500 - $5,000 (5% fixed from the Initial balance)

Day 3:

- The account registers an unrealized loss of $4,500 and Equity goes down to 99,000 at End of Day

Next Day:

- Max Loss Trigger Level: $90,000 (stays static at 90% of the initial balance from the start)

- Max Daily Loss trigger level: $94,000 = End of Day Equity of $99,00 - $5,000 (5% fixed from the Initial balance)

Day 4:

- The account registers a profit of $6,000 loss reaching end of day Equity of of $105,000

Next Day:

- Max Loss Trigger Level: $90,000 (stays static at 90% of the initial balance from the start)

- Max Daily Loss trigger level: $100,000 = End of Day Equity of $105,00 - $5,000 (5% fixed from the Initial balance)

500K (Trailing)

This is the limit on the maximum loss a user can sustain in the lifetime value of their account in each phase. Violating this limit is a hard breach, meaning loss of account access.

The loss limit is calculated versus the maximum value of the account over time. Any increase in the account balance from the starting balance will be treated as a new high water mark for the account (HWM).

The Max drawdown limit is a “trailing” limit, meaning it is calculated versus the high water mark which increases as the value of the account balance increases. Account balance reflects Realized P&L. HWM will not be calculated from position with unrealized Profit. The maximum drawdown limit will trail up to the maximum of the initial balance. The HWM and max drawdown level will be maintained and not decrease if the Account Balance/Equity decreases.

Do note: The maximum drawdown limit level can be monitored via the Prop Trader Dashboard portal.

Example 1 : How daily loss limit and max drawdown works

Day x - Over several days the user has built an unrealized profit of $25,000

- Unrealized profit/loss (P&L): $25,000

- Account Equity: $525,000

- Next day

- Max daily loss amount: $26,250 ($525,000 * 5%)

- Max daily loss equity trigger level: $498,750 ($525,000 - $26,250)

-

- Max drawdown limit: $450,000

- Max drawdown limit: $450,000

Day xx - The user has generated an additional $15,000 in profit, bringing their total balance to $540,000

- Realized profit/loss (P&L): $15,000

- Account Balance is the same as Account Equity (all PL is realized): $540,000

- Next day

- Max daily loss amount: $27,000 ($540,000 * 5%)

- Max daily loss equity trigger level: $513,000 ($540,0000 - $27,000)

- Max drawdown limit: $490,000 ($540,000- $50,000 (10% of the initial balance of $500,000))

Day xx +1 - The user makes an unrealized loss of $25,000

- Unrealized profit/loss (P&L): $25,000

- Account Equity: $515,000

- Next day

- Max daily loss amount: $25,750 ($515,000 * 5%)

- Max daily loss equity trigger level: $489,250 ($515,000 - $25,750)

- Max drawdown limit: $490,000 ($540,000 - $50,000 (10% of the initial balance of $500,000)Max drawdown level does not trail up since there is no new HWM balance update intraday. The level also doesn’t trail down either but stays at the same level as reached from the highest watermark balance value.

Day xx +2 - The user makes an additional unrealized loss of $25,750

BREACH

- Unrealized profit/loss (P&L): $50,700

- Account Equity: $489,250

- Next day

- Max daily loss amount: $25,750 ($515,000 * 5%)

- Max daily loss equity trigger level: $489,250 ($515,000 - $25,750)

- Max drawdown limit: $490,000 ($540,000 - 10% x initial balance of or $50,000) Since there was a new High Water Mark of realized Profits on the account for total of 540,000 then the Max drawdown limit trigger level will be $490,000 = $540,000 - $50,000 Trailed up

Example 2 : How Max Drawdown trails up to the Initial balance

Day x - Over some time, the user brings the realized P&L of the account to $600,000

- Account Balance = Account Equity (Realized P&L): $600,000 (new HWM on the account)

- Daily loss limit: $30,000 (5% of $600,000)

- Daily loss limit trigger level: $570,000

- Max Drawdown Limit trigger level: $500,000

- $600,000 (HWM) - $60,000 (10% from Initial Balance= $540,000. However, this is higher than the initial balance of $500,000 hence the Max Drawdown will be capped to the Initial balance level of $500,000.

How do I calculate the New Maximum Drawdown Limit of the $500k account when requesting a payout (trailing)?

To determine the breach level of the maximum drawdown limit:

Step 1 - Calculate the New Max Drawdown Level

Step 2 - Compare the New Max Drawdown Level to the initial balance

If the value is more or equal to the starting balance, the Maximum Drawdown level remains at the starting balance.

If the value is less than the starting balance, that value becomes the new Maximum Drawdown level.

Formula:

New Maximum Drawdown (Max DD) Level = HWM Balance - Payouts requested - 10% of the initial balance

The High Water Mark (HWM) Balance is the highest point of the account balance.

Assume a 500k account, initial Max Drawdown Level = $450k (10% Maximum Drawdown Limit)

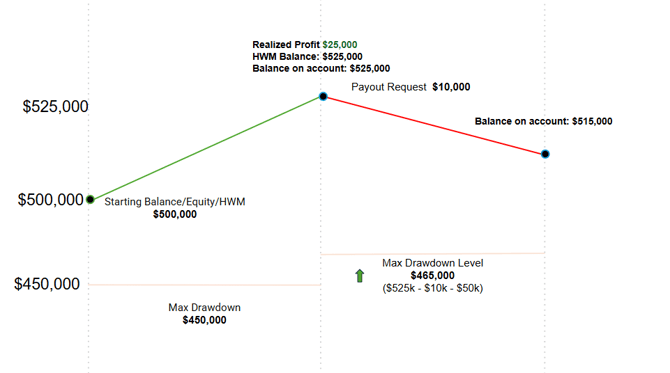

Scenario A - Request for payout when the account is at its HWM level

- Realized Profit on the Account = $25k

- HWM Balance = $525k

- Balance on the Account = $525k

- Maximum Drawdown = $475k (Trailing: HWM Balance $525k- $50k (10% from initial balance of 500,000)

- Request Payout = $10k

- Balance after payout = $515k

New Max Drawdown Level = 525 - 10k - 50k =465k

Distance between Balance after payout and New Max Drawdown = $515k - $465k = $50k buffer

Scenario B - Request for payout when the account is below its HWM level

- Realized Profit on the Account = $25k

- HWM Balance = $525k

- Balance on the Account = $525k

- Maximum Drawdown = $475k (Trailing: HWM Balance of $525k - $50k (10% from initial balance of 500,000)

- Realized Loss from trading after reaching HWM Balance = $10k

- Balance on the account after realized loss from trading = $515k (HWM Balance is still @ $525k)

- Request Payout = $15k

- Balance after payout = $500k

New Max Drawdown Level = 525 - 15k - 50k = 460k

Distance between Balance after payout and New Max Drawdown = $500k - $460k = $40k buffer

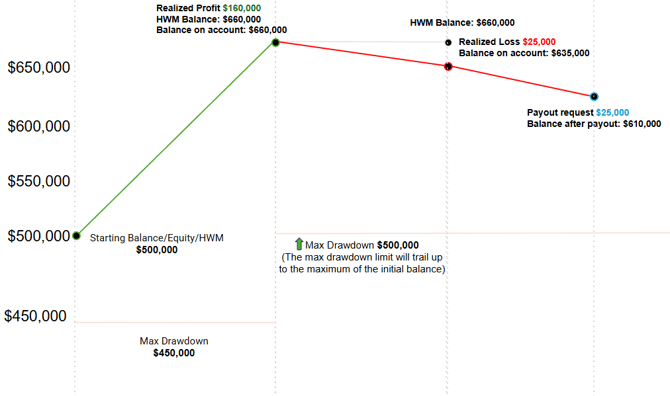

Scenario C - Request for payout when the account is below its HWM level

- Realized Profit on the account = $160k

- HWM Balance = $660k

- Balance on the Account = $660k

- Maximum Drawdown = $500k (Stop Trailing - The maximum drawdown limit will trail up to the maximum of the initial balance.)

- Realized Loss from trading after reaching HWM Balance = $25k

- Balance on the account after realized loss from trading = $635k (HWM Balance is still @ $660k)

- Request Payout = $25k

- Balance after payout = $610k

New Max Drawdown Level = 660k - 25k - 50k = 585k > Initial Balance = Max DD remain at 500k

Distance between Balance after payout and New Max Drawdown = $610k - $500k = $110k buffer

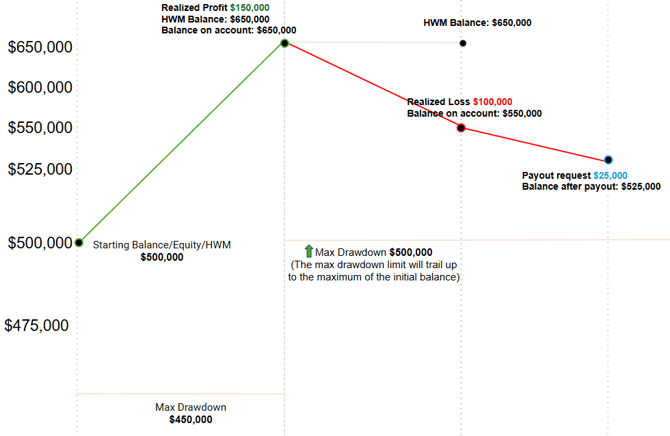

Scenario D - Request for payout when the account is below its HWM level

- Realized Profit on the Account= $150k

- HWM Balance = $650k

Balance on the account = $650k - Maximum Drawdown = $500k (Stop Trailing - The maximum drawdown limit will trail up to the maximum of the initial balance.)

- Realized Loss from trading after reaching HWM Balance = $100k

- Balance on the account after realized loss from trading = $550k (HWM Balance is still @ $650k)

- Request Payout = $25k

- Balance after payout = $525k

New Max Drawdown Level = 650 - 25k - 50k = 575K > Initial Balance = Max DD remain at 500k

Distance between Balance after payout and New Max Drawdown = $525k - $500k = $25k buffer

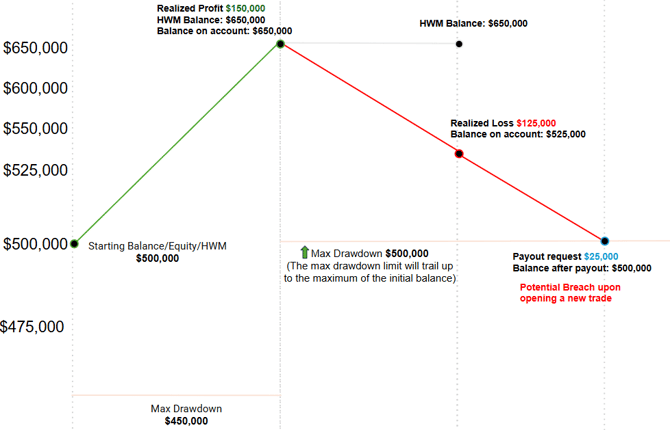

Scenario E - Request for payout when the account is below its HWM level

- Realized Profit on the Account = $150k

- HWM Balance = $650k

Balance on the Account = $650k - Maximum Drawdown = $500k (Stop Trailing - The maximum drawdown limit will trail up to the maximum of the initial balance.)

- Realized Loss from trading after reaching HWM Balance = $125k

- Balance on the account after realized loss from trading = $525k (HWM Balance is still @ $650k)

- Request Payout = $25k

- Balance after payout = $500k

New Max Drawdown Level = 650 - 25k - 50k = 575K > Initial Balance = Max DD remain at 500k

Distance between Balance after payout and New Max Drawdown = $500k - $500k = $0k buffer Potential Breach upon opening a new trade